35+ how long work history for mortgage

Web Generally speaking mortgage lenders require that you have at least two years of employment history to qualify for a loan. Then about 10 days before.

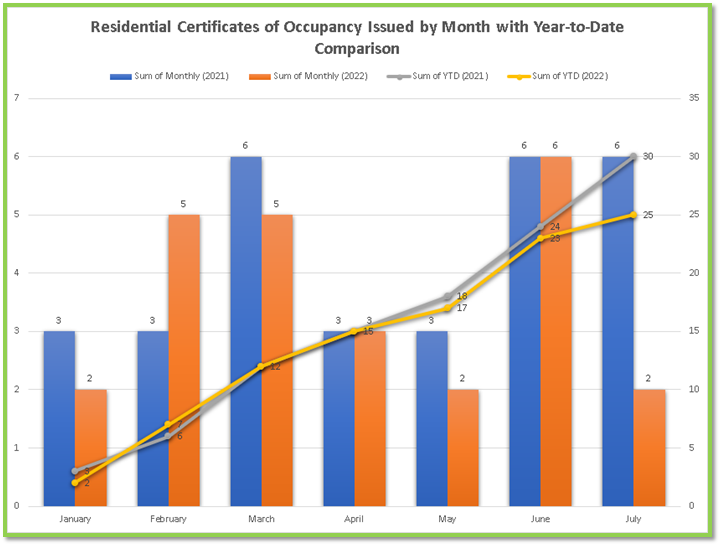

Management Report August 2022

Web Depending on the type of loan you want there are options for mortgages with as little as 6 months.

. Apply Now With Quicken Loans. In fact they will go back at least 24 months inquiring about where you worked as well as your. FHA only requires 6 months but most lenders want at least 1 year.

Ad Compare the Best Home Loans for March 2023. Compare offers from our partners side by side and find the perfect lender for you. Web With 6 months of work gaps you can get a mortgage but you have to provide as following also.

What More Could You Need. And yes lenders frequently. Complete all Required Fields for the.

Web The FHA Back To Work program is a mortgage loan program available via the FHA which reduces the waiting period to purchase a home after bankruptcy. Ad Check Your FHA Mortgage Eligibility Today. Provided your last pay stubs covering 30 days of wages you need to.

Youll also need to show bank. Web Add Employment History 1. Apply Now With Quicken Loans.

Savings Include Low Down Payment. How Much Interest Can You Save By Increasing Your Mortgage Payment. Web Here at Rocket Mortgage we usually verify your employment with your employer either over the phone or through a written request.

An ideal scenario is when the borrower has at least two years of. From the Employment History section of the Individual MU4 Form click the Add button. What More Could You Need.

Web Yes there is a standard within the mortgage industry that borrowers should have at least two years of employment and income history. Ad Compare Mortgage Options Calculate Payments. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

To ensure you meet those. Ad Compare Mortgage Options Calculate Payments. Get Instantly Matched With Your Ideal Mortgage Lender.

In previous years lenders were happy to provide mortgages with 20 to 30 year periods. Web In this case youll be asked for two years worth of income tax returns including forms like your T1 and notices of assessment. Contact a Loan Specialist to Get a Personalized FHA Loan Quote.

Web As a rule of thumb mortgage lenders will typically verify your employment and income for the last two years. Web Two Years the Standard Most lenders prefer lending to borrowers who have worked in the same field for at least two years believing they will more likely remain. Apply Get Pre-Approved Today.

Web Interest rates rose sharply throughout the 1970s and 1980s and eventually rose above 20. Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Lock Your Rate Today.

Web Lenders want to know a lot about your work history when you apply for a mortgage.

About Us Family First Funding

A Main Street Perspective On The Wall Street Mortgage Crisis

Can Rent Act As Savings In Your Mortgage Application Lending Specialists

5 Killer Reasons Handwritten Notes For Mortgage Brokers Just Work Templates Audience Handwritten Mail

Q4 2022 Friends Of Provenance Blockchain Quarterly Update Highlights By Provenance Blockchain Foundation Provenance Blockchain Medium

Social Security United States Wikipedia

Daily Corona Virus Mortgage Updates Mortgage Broker Vancouver Bc Burnaby Bc Canada

Refinance Mortgage Lenders Az Sun American Mortgage

Bharat Bhama Resume

Can You Qualify For A Mortgage While On Probation At Your Job Mortgage Rates Mortgage Broker News In Canada

Everything You Need To Know About Benddao Bend 101 Blockchains

Home Buying With A New Job How Long Must You Be Employed

Fha 203k Loan Renovation Mortgage Loans Explained

Can I Get A Mortgage Without Two Years Work History Find Out How

Mortgage With Short Employment History Lending Guidelines

Do You Need Two Years Of Continuous Employment History To Qualify For A Mortgage Ratebeat California S Best Mortgage Lender

Vernon Mortgage Broker Peter Pogue Kal Mor Mortgages Investments